ventura property tax rate

Tax Rate Database - Ventura County. The average yearly property tax paid by Ventura County residents amounts to about 361 of their yearly income.

2022 Best Places To Live In Ventura County Ca Niche

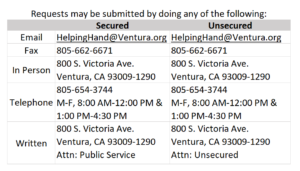

Secured property taxes are taxes levied on real property.

. Camarillo City 373 07 1090900 1154338. As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID. Ventura County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly youre unfamiliar that a property tax bill.

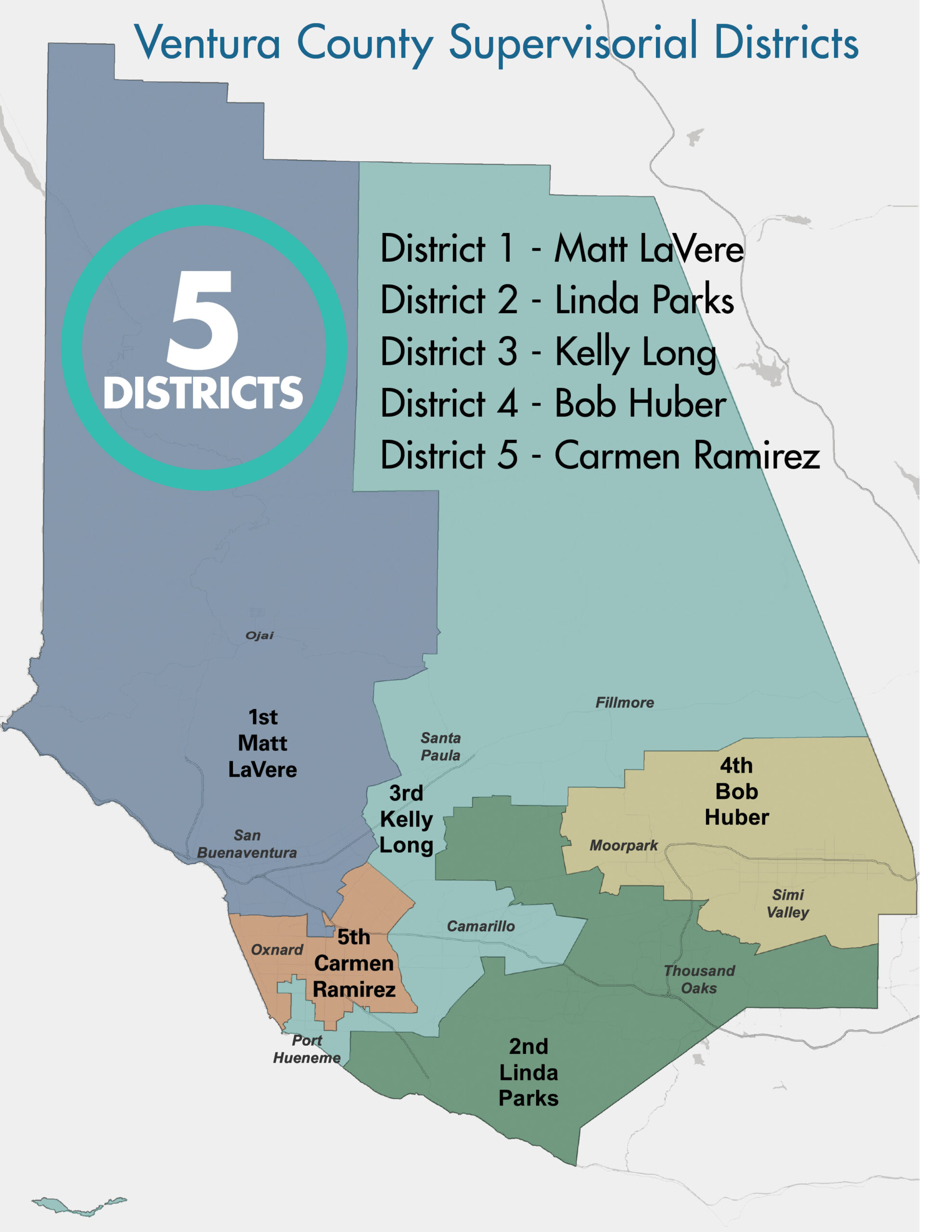

This includes land all mines mineral and quarries in the land and improvements among others. Ventura County is ranked 342nd of the 3143 counties for property taxes as a. Explore how Ventura imposes its real property taxes with our thorough guide.

Treasurer-Tax Collector - Ventura County. City or School District Areas Areas Tax Rate Range. Property Tax- Description - Ventura County.

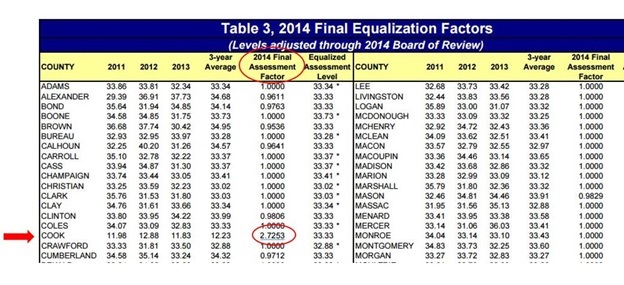

1 is the max that the. Property tax process on a county-by-county basis. The Ventura County property tax rate is 125 of the assessed property value.

Revenue Taxation Codes. County Line Sales Taxes Property Taxes Below is a general idea of what to expect to pay in property taxes in each city. Receives the assessments from the Assessor and applies the appropriate tax rate to determine the actual amount of property taxes owed.

Our Ventura County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. County of Ventura - WebTax - Search for Property. Of Tax Rate.

Tax Rates and Other Information - 2021-2022 - Ventura County. Ventura City 186 05 1034700 1169900. Mails out the property tax bills.

Pay Your Taxes - Ventura County. Whether you are already a resident just pondering moving to Ventura or interested in investing in its real estate. Revenue Taxation Codes.

The minimum tax is 750 for each tax bill. Ventura Property Taxes Range Ventura Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps youre unaware. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of.

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

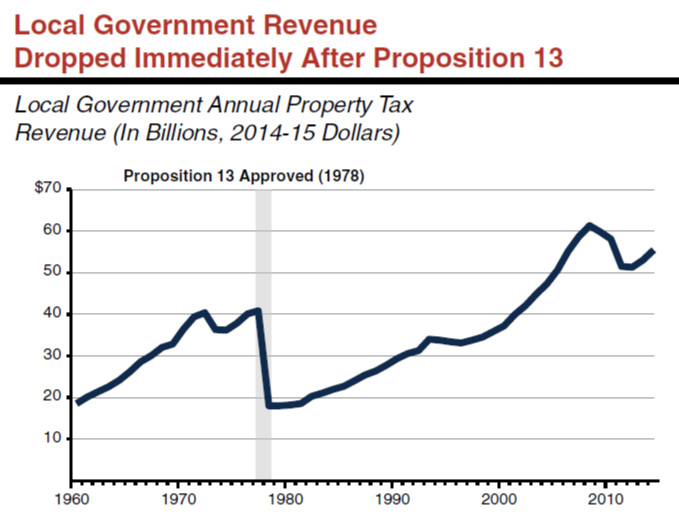

Californians Adapting To New Property Tax Rules City National Bank

The Best Property Management Companies In Ventura California Of 2022 Propertymanagement Com

Report 32 Million Pounds Of Toxic Pesticides Sprayed On Ventura County Fields From 2015 To 2020 Environmental Working Group

How To Transfer California Property Tax Base From Old Home To New

Ventura And Los Angeles County Property And Sales Tax Rates

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

Snellville Property Tax Rate To Decrease But Some Homeowners Will Pay More

Calculate Your Community S Effective Property Tax Rate The Civic Federation

%20(002)NEOGOVWEBSITE.png?upscale=True)

Employment Opportunities Sorted By Job Title Ascending Welcome To The County Of Ventura

Tax Collector Faq S Ventura County

Special Districts Division City Of Oxnard

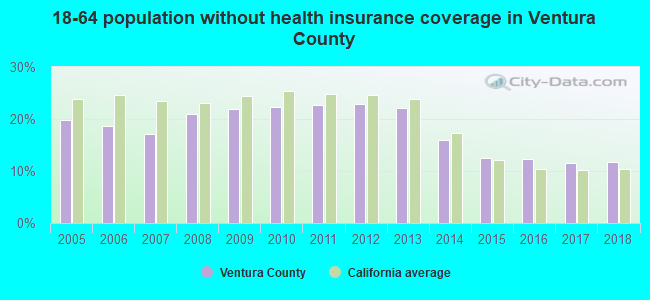

Ventura County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

How To Calculate Property Tax San Juan County Wa

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts