arizona charitable tax credits 2020

Everything you need to know to take advantage of the Arizona Charitable Tax Credit updated for the 2021 tax year. Qualifying Charitable Organizations and Qualifying Foster Care Charitable Organizations.

Tax Credits For Donations To Area Groups And Schools Local News Paysonroundup Com

That exceed the allowable credit on Arizona Form 323 590 S MFS HoH.

. Marys Food Bank and get all of it back in your Arizona tax refund. For all of them you have until April 15 2021 or until the date you file. A taxpayer can contribute and take all the credits subject to the amount of state tax for any particular year.

Click the link for detailed info at the. February 5 2020 311 PM. The state of Arizona provides a variety of individual tax credits including the.

Arizona charitable tax credits 2020. You can provide free healthcare for those in need at no cost to you. 10 rows Arizona Small Business Income Tax Highlights.

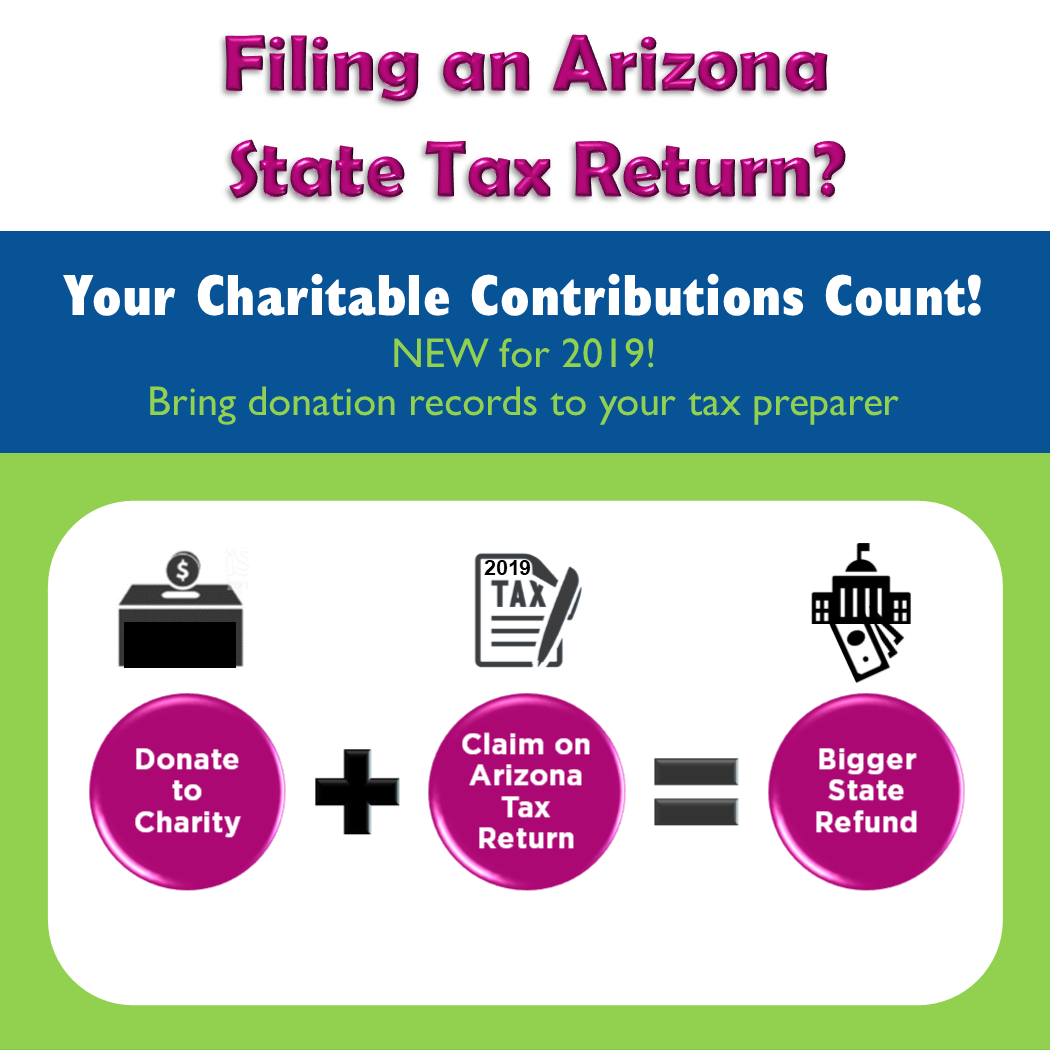

The Arizona Department of Revenue ADOR advises taxpayers they have until May 17 to make donations to qualifying charitable organizations to claim the tax credits on their 2020 individual income tax return. Any credits for charitable contributions to Qualifying. Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals.

A taxpayer can contribute and take all the credits subject to the amount of state tax for any. For voluntary contributions made to a qualifying foster care charitable organization QFCO see credit Form. The Arizona Charitable Tax Credit gives taxpayers more choice in how their tax dollars are allocated.

There are four major tax credits that you can use to offset certain charitable donations in Arizona. With the Arizona Charitable Tax Credit you can donate up to 800 to St. 3 hours agoBy reinstating the expanded and monthly child tax credit which expired earlier this year 92 of all children in Arizona would benefit and millions of families would see immediate.

Donations made between January 1 2021 and April 15 2021 can be claimed as a credit on either your 2020 or 2021 state tax return. The Arizona Foster Care Tax Credit offers a dollar-for-dollar reduction of your state income tax obligation for donations to a Qualifying Foster Care Charitable Organization such as AASK. Contributions in all other.

Neither Charter Schools nor programs run by charter schools are qualified. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations qualify. There are five 5 different types of charitable donation credits to choose from with limits depending on your filing status end of.

Public Schools Form 322 A credit of up to. Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400. Consider the example of a single taxpayer who makes a 400 donation to an eligible.

Contributions to QFCOs made between January 1 2021 and April 15 2021 can be claimed as a credit on your 2020 or 2021 Arizona tax return. This credit is limited to the amount of tax calculated on your Arizona return. Tax Planning with Arizona Credits.

A couple filing a joint return in Arizona can qualify to redirect as much as 4965 for 2020. Arizona provides two separate tax credits for individuals who make. You may receive a dollar-for-dollar tax credit for contributions to the following types of charitable organizations.

Up to April 15 2021. Key and Concise Point About Arizona Charitable Tax Credits. You can also get a tax break for making donations to a qualified charitable organization or foster care organization or to the Arizona Military Family Relief Fund which provides financial.

Arizona Department of Revenue. The Arizona Charitable Tax Credit is a dollar-for-dollar tax credit that reduces the taxpayers tax liability what is owed for AZ state taxes.

Arizona Tax Credits Az Tax Credits 2020 Price Kong

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

Charitable Contributions Count In Arizona Tempe Community Council

Arizona Charitable Tax Credit Donations St Mary S Food Bank

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Donate Now Tax Credit Open Hearts Family Wellness

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Qualified Charitable Organizations Az Tax Credit Funds

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

List Of 6 Arizona Tax Credits Christian Family Care

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Cheapest Colleges In Arizona 2017 Collegestats Org College Rankings College Fun Dream School